PA CLGS-32 - Dannville 2012-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

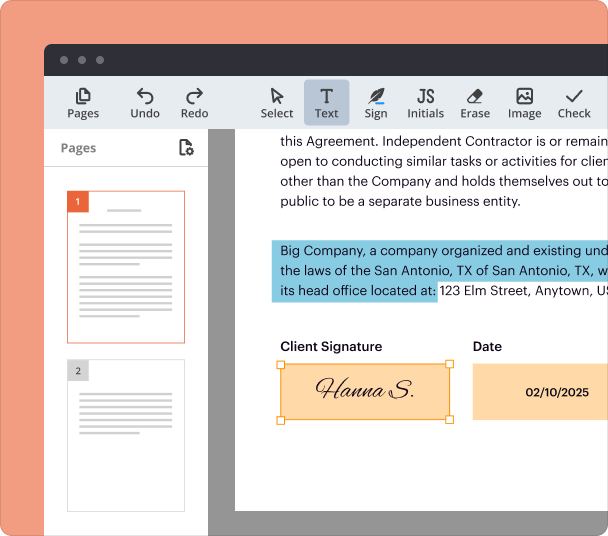

Edit and sign in one place

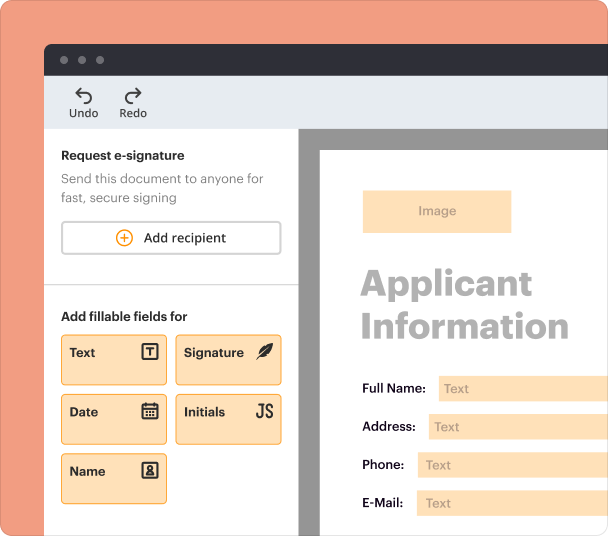

Create professional forms

Simplify data collection

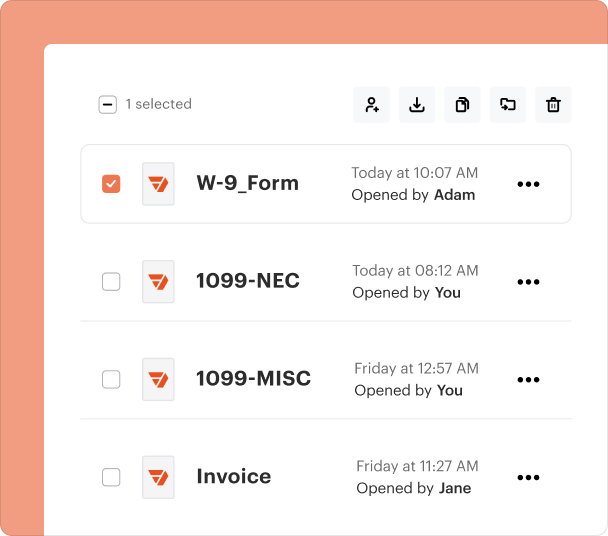

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the PA CLGS-32 - Dannville Form

What is the PA CLGS-32 - Dannville Form?

The PA CLGS-32 - Dannville is a local earned income tax return form designated for residents of Danville, Pennsylvania. It is used to report annual local earned income and determine the amount of local tax owed based on an individual's earnings throughout the year. The form requires personal identification information, income details, and relevant tax credits.

Key Features of the PA CLGS-32 - Dannville Form

The PA CLGS-32 form includes several key features designed for accuracy and clarity. These features encompass sections for reporting gross compensation, unreported employee business expenses, and any deductions related to earned income. Additionally, it allows for the inclusion of spouse's income where applicable, and it emphasizes the importance of attaching necessary documentation, such as W-2 forms and any other pertinent tax schedules.

Eligibility Criteria for the PA CLGS-32 - Dannville Form

Eligibility to file the PA CLGS-32 form generally pertains to residents of Danville who earned income locally. This includes individuals engaged in employment, self-employment, or business operations that generate taxable income. Particular conditions, such as being disabled, deceased, or retired, need to be explicitly indicated if an individual had no earned income during the reporting period.

How to Fill the PA CLGS-32 - Dannville Form

Filling out the PA CLGS-32 form requires careful attention to detail. Taxpayers should start by providing their personal information, including social security numbers and contact details. The next step involves reporting the total gross income earned. Taxpayers must accurately complete all sections, ensuring that all calculations are precise and that appropriate documentation, such as W-2s, are enclosed to substantiate reported income.

Common Errors and Troubleshooting

Common errors in completing the PA CLGS-32 form include misreporting income, failing to include necessary documents, and overlooking various sections that may apply to a taxpayer's situation. It is vital to double-check all entries for accuracy and ensure that required forms are attached to avoid delays in processing or potential rejections.

Submission Methods and Delivery

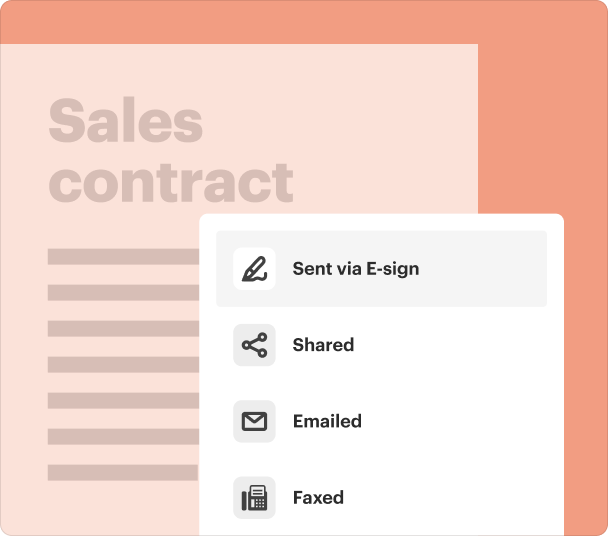

Completed PA CLGS-32 forms can typically be submitted via mail or electronically, depending on the local tax office's regulations. Taxpayers should ensure that they are aware of any specific submission timelines and methods prescribed by the Danville Area Earned Income Tax Office to avoid late penalties. Keep copies of the filled-out form and any communication with the tax office for personal records.

Frequently Asked Questions about Clgs-32 812

What documents do I need to file the PA CLGS-32?

Necessary documents include your completed PA CLGS-32 form, W-2 forms from your employer(s), and any additional schedules related to your income or deductions if applicable.

Where can I find a printable version of the PA CLGS-32 form?

The PA CLGS-32 form can typically be found through local tax office websites or document management platforms offering free printable templates.

pdfFiller scores top ratings on review platforms